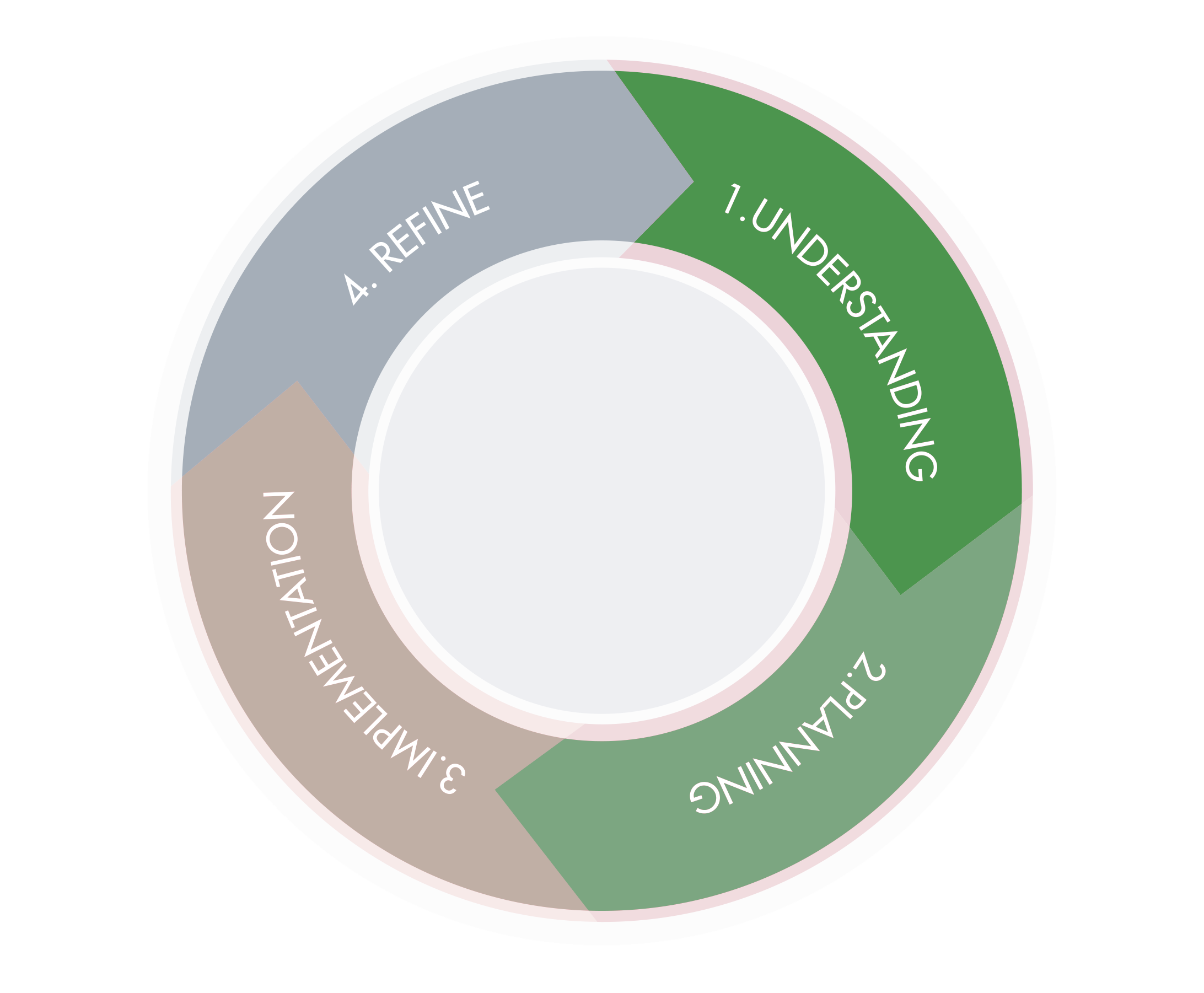

Before we give you investment advice we first make sure we clearly understand your current financial situation, your goals, and how much risk you are willing to take with your money.

Only when we’ve done this can we recommend the right investment products so you can make an informed choice.